Investment in systemic risk reduction and resilience can deliver a triple dividend by avoiding loss, reducing the costs of future disasters and unlocking economic opportunity and environmental and social benefits.

Despite the growing recognition of the urgency to invest in disaster resilience, there is a substantial shortfall in funding. The majority of the funding is from public sources. Private sector investment is needed to bridge the gap in finance so that communities, ecosystems and economies improve resilience to the growing effects of disasters and climate change.

The private sector can play a crucial role in investing in resilience-building to prepare for and recover from emergencies and disaster events. However, current approaches to assessing the benefits of investment tend to focus on mitigating immediate risks to assets and operations, while neglecting other opportunities for innovation and value creation. Such a narrow perspective fails to recognise the rising costs and effects of disasters, particularly in the context of cascading and compounding risks. It has been recognised that, across the globe, we are facing a ‘new normal’ of inter-related global risks with compounding effects that amplify consequences (polycrisis) that can only be addressed through systemic responses.

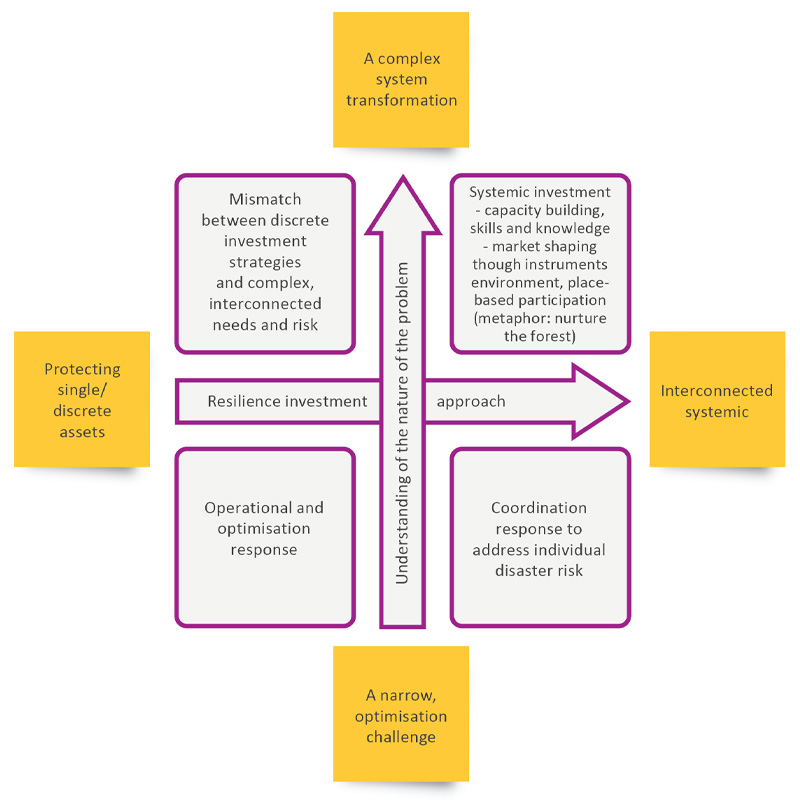

Figure 1 maps the importance of matching decision-making and management approaches to the nature of problems. Systemic approaches create a pathway to recognise the systemic nature of the challenge and that systemic problems need systemic solutions.

To ensure long-term sustainability in uncertain futures, the private sector can actively use systemic solutions for investment. By harnessing innovation and problem-solving capabilities and building roles and relationships with communities and nature, businesses can be transformative, instigate change and build resilient societies.

The Resilient Futures Investment Roundtable (RFIR)1 is a coalition of public, private, research and not-for-profit organisations in Australia that work together to increase the flow of investment into disaster resilience. The RFIR is a forum and provides resources to enable organisations, including the private sector, to take systemic approaches to disaster resilience investment.

Over the past 2 years, RFIR members have shared expertise and experiences from practice. We have found that organisations struggle to effectively match the approach to risk assessment and investment decision-making to the nature of the problem. This makes it difficult to align investment with solutions that deliver real resilience. To counter this, the RFIR membership provides a many-perspective approach to help identify how the private sector can leverage its expertise and resources and can take on roles to lead systemic disaster resilience efforts.

Figure 1: Mapping resilience investment to the nature of the problem.

Harness skills and knowledge

Through dialogue, policy engagement, formalised partnerships and taking a co-creation approach to project development, the private sector can bring skills, knowledge and expertise to take an active role in developing climate resilience solutions. The RFIR is one platform for cross-sectoral knowledge sharing and capability building. It was created following research released by the Australian Business Roundtable for Disasters and Safer Communities2 that found that investment was urgently needed to manage the rising costs and effects of disasters, but organisations needed support to make informed resilience investment decisions. The RFIR leverages the collective expertise of members to build capability and support diverse organisations, including the private sector, to make informed decisions for the future and to manage disaster risk and invest in a resilient, climate-adapted future.

Support early innovation

The private sector can move beyond its historic roles to look for opportunities to support early innovation. For example, as part of the Resilience Investment Vehicle, NAB and IAG explored debt financing and insurance premium reductions for property owners who undertake identified bushfire resilience upgrades on their homes. As part of that work, NAB and IAG supported the development of the Bushfire Resilience Star Rating app.3 This highlighted how the private sector can take on an expanded role to support innovative approaches to encourage uptake of resilience measures using financial incentives. This is documented in the Resilience Investment Vehicle Insights Report.4 Creating an environment for greater private sector investment in solutions is an ongoing area of work.

Participate in place-based resilience planning

The Enabling Resilience Investment approach5 is a collaboration between CSIRO and Value Advisory Partners that has developed a place-based approach to investment. It provides a methodology for diverse local stakeholders representing various sectors and interests in a city or suburb. Stakeholders participate in collaborative workshops to identify risk-mitigation and the value that these options create in the community. This could be through jobs, infrastructure, social cohesion, economic activity and incomes. This identification of value to a broad range of stakeholders creates opportunities for novel funding and financing mechanisms. To date, these types of place-based efforts have tended to be led by local and state government and can be strengthened by greater participation from the private sector.

Support community-led resilience

The private sector can provide expertise and resources to help communities withstand and recover from disasters. For example, supported by ResilientCo and the Minderoo Foundation, the Millgrove community (63km east of Melbourne, Victoria) conducted a community-led planning process and identified initiatives to improve the township’s resilience. One activity focused on local renewable power capacity and a community electricity microgrid to operate during emergencies and reduce power costs locally. The community identified a need for a 'community emergency hub' to provide relief to people and emergency workers before infrastructure gets up and running again.

Together with Toyota Australia, the Millgrove community is examining the feasibility of a hydrogen-powered generator to keep critical facilities running during and immediately after an emergency event. Details are available at The Resilience Canopy6 website.

Work with boundary organisations

Boundary organisations act as a bridge between stakeholders to facilitate communication, collaboration and the exchange of knowledge and resources across traditionally separate sector or disciplines. Systemic resilience investment works when all sectors (public, private, not-for-profit, research and communities) combine expertise and perspectives about systems and disciplines. Boundary organisations such as Climate-KIC Australia facilitate this collaboration and help to bridge the gap between stakeholders, for example, through convening cross-sectoral efforts like the RFIR.

To realise the potential in climate resilience investment, businesses must think creatively about their role and consider unconventional approaches to participate in creating resilient futures. Taking a systems approach leads to working with partners and communities in new (and perhaps uncomfortable) ways. These new ways of working recognise that businesses are important parts of local communities, ecosystems and economies and that systemic resilience protects everyone against risks and is a building block for long-term sustainability.